- Prenumerera på RSS-flöde

- Markera inlägget som nytt

- Markera ämnet som läst

- Pinna detta Inlägg för min användare

- Bokmärke

- Följ

- Inaktivera

- Utskriftsvänlig sida

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Meals as part of the business expenses/costs, not representation

Hi, I just was recently hierd to run a filming production, the whole crew is paid by my client but whilst in Sweden I had to pay for meals and supply for the crew, which my client reimbursed me for. But as I have paid all the tickets and meals and everything they need, it is a cost for me to be able to run my business, not representation or marketing, as I have also charged a fee to do the scouting, producing, etc.

I am confused as I am not sure if I should log these meals as consumables or representation costs.

I am an enskildfirma, any help on this would be highly appreciated.

Thank you

Löst! Gå till lösning.

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Hi

Are you reimbursed for your expences with the same amount? If so the easiest way is to account for the expenses as an asset first and when you get the payment from your client for the reimbursement you just remove the asset.

1. When you pay for a meal you account for that payment like follows

1930 bank Credit 1 000

1681 Expenses for customers Debet 1 000

2. When you a while later recieve the reimbursement for the expenses you account for it the same way but debet and credit are reversed.

1930 Bank Debet 1 000

1681 Expenses for customers credit 1 000

By handeling it this way the expenses doesn't effect your own accounting.

/Joachim

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Thanks a lot this is the solution I was looking for.

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

You're welcome.

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

My only question is, with this method, can I then issue an invoice for my client?

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Hi

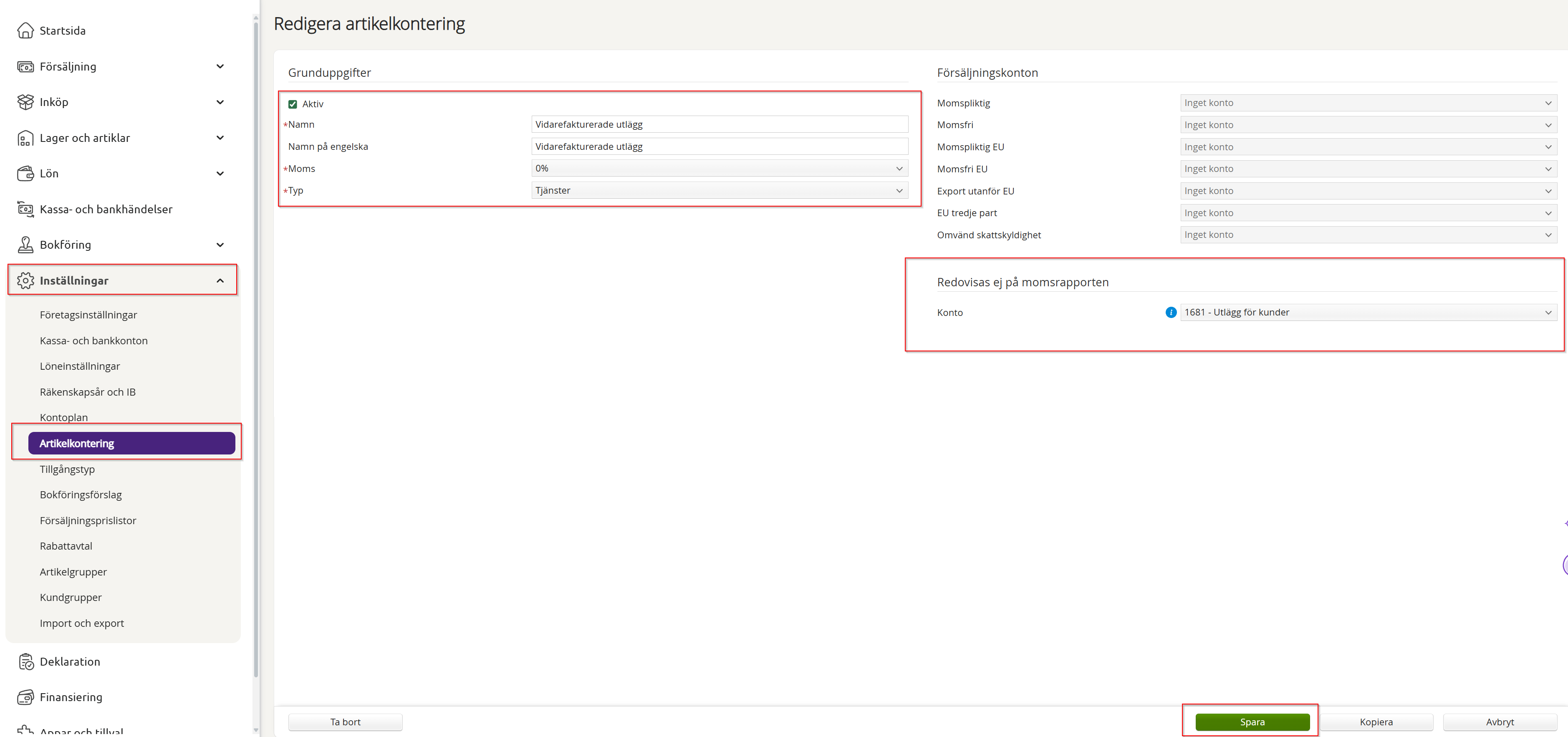

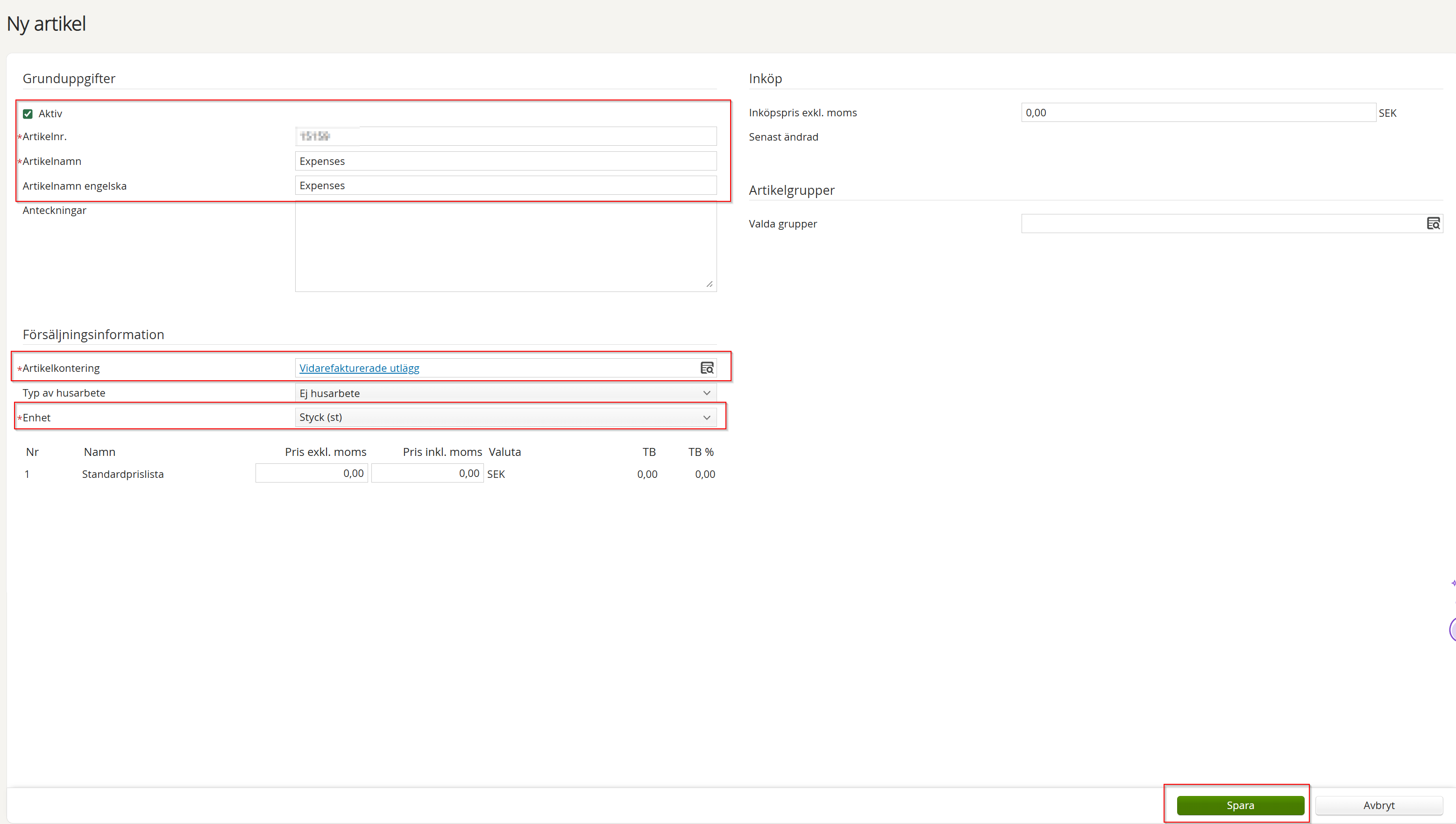

Sure you just need to set up a new artikelkontering and article witch you use when you create the invoice with the expenses to the customer.

It can look like the picture below.

Artikelkontering

Article to use on the invoice.

/Joachim

Utbildningar

Spiris

Copyright 2025 Visma Spcs. All rights reserved.