- Prenumerera på RSS-flöde

- Markera inlägget som nytt

- Markera ämnet som läst

- Pinna detta Inlägg för min användare

- Bokmärke

- Följ

- Inaktivera

- Utskriftsvänlig sida

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Purchase of goods outside EU

I am an enskild firma, I travel a lot and often buy goods outside the EU for use in my business. They are generally tools or consumables that are used to carry out my business, and not things that I will be selling on. They can range in value from 100 up to 5000 kr or so.

When bookkeeping, I believe I have to add MOMs, which I can then claim back as a MOMs registered entity.

What are the implications with customs here? Because the goods are not posted and are carried personally, they do not have import declarations. Should I be declaring them when I arrive in Arlanda? Or some other way?

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Hi

To start with if you don't fill out a form about any reclaim of the VAT in teh country you visited is not deductable when you account for the purchase. it will be handled if you get a refund of the VAT later. Then you reduce the cost with tha refunded amount.

The purchases should you account for without VAT.

I show with an example.

The amount paid is 500 SEK. (It always has to be accounted for in SEK against the purchase days currance value.

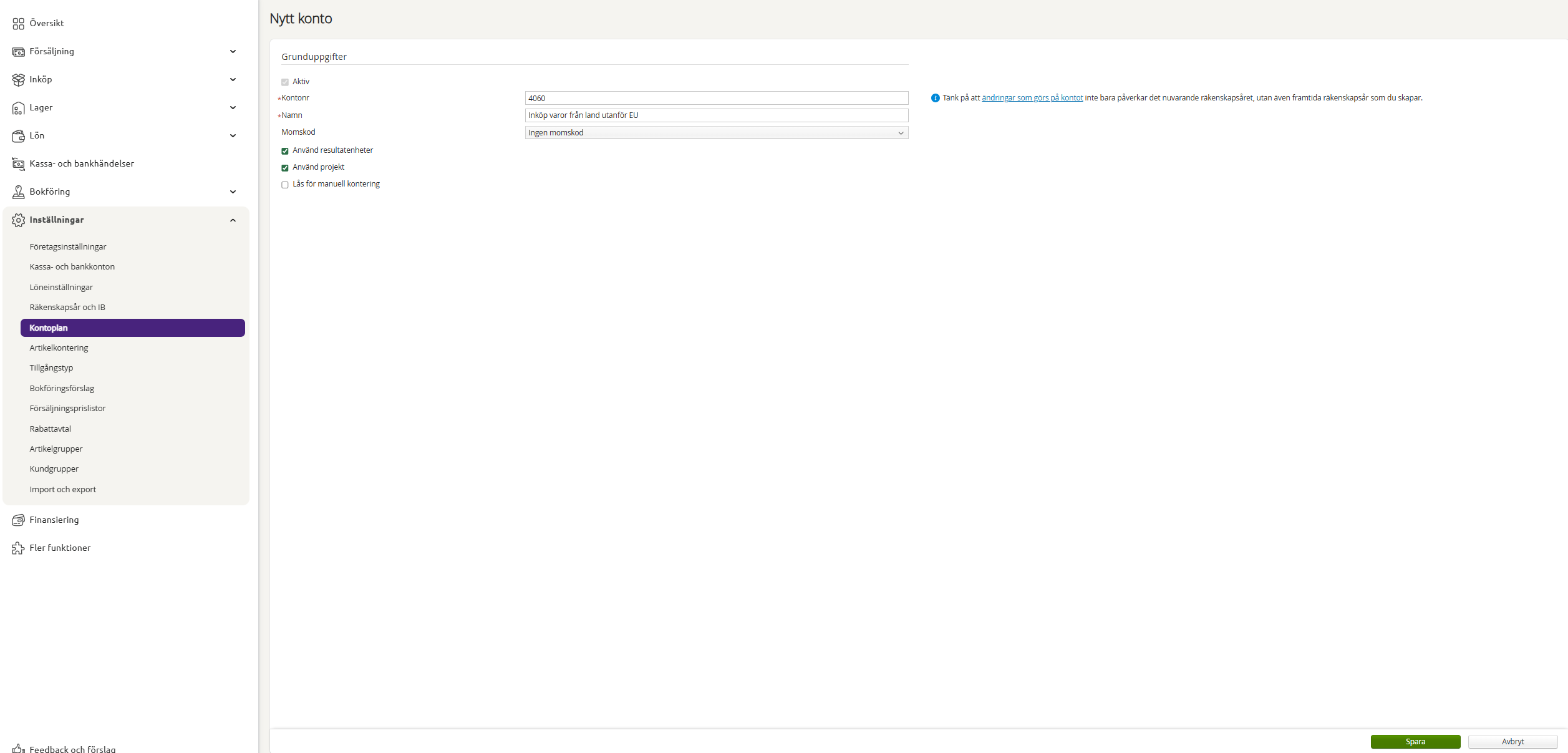

I recommend that you create a new account for these transactions.

Create account 4060 under Inställnignar > Kontoplan.

Then you account for the purchase like below.

1930 Credit 500

4060 Debet 500

If you get a refund you account for it like this

1930 Debet (Amount recieved)

4060 Credit (Amount recieved)

The total cost will then be reduced with the refund.

/Joachim

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Thanks Joachim,

I am aware that I can't claim the foreign country's VAT back, and it's not ever really worth the time effort to claim it back, but according to Skatteverkets information, it looks to me like I have to declare the MOMs amount that would be charged in Sweden.

From Skatteverket

Om du är momsregistrerad och importerar varor till din verksamhet ska du redovisa och betala moms på importen till Skatteverket. Detta gäller också för dig som är momsregistrerad och importerar varor med hjälp av ett ombud som tulldeklarerar åt dig.

I momsdeklarationen redovisar du beskattningsunderlaget i fält 50 (i svenska kronor). Den beräknade utgående momsen redovisar du i något av fälten 60-62, beroende på vilken momssats som gäller för den vara som du har köpt. Du får göra avdrag för den moms som du själv har beräknat enligt de allmänna reglerna för ingående moms i fält 48.

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Hi

That depends if the products you bring home are declared or not. If you buy products on sight as a private person you are not registering you VAT number which meens you buy them as a private person and then no company VAT has to be accounted for.

It is correct that you shold account for an import VAT but that only applies if you get a statment from the customs or from a freight company that states that VAT has to be reported.

I would say that this question is better to contact skatteverket with directly.

/Joachim

Utbildningar

Spiris

Copyright 2026 Visma Spcs. All rights reserved.