- Prenumerera på RSS-flöde

- Markera inlägget som nytt

- Markera ämnet som läst

- Pinna detta Inlägg för min användare

- Bokmärke

- Följ

- Inaktivera

- Utskriftsvänlig sida

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Bookkeeping for Etsy Purchases

Hello there,

I would like to ask for some guidance on how to record purchases made through Etsy. I’ve bought several items from Etsy merchants for my company (sole trader), but none of the purchase receipts include my VAT registration number.

Currently, this is how the transactions appear in my bookkeeping. These accounts were originally set up by my accountant:

2440 – Leverantörsskulder

4545 – Import av varor, 25 % moms (VAT code 50)

2615 – Utgående moms import av varor, 25 % (VAT code 60)

2645 – Beräknad ingående moms på förvärv från utlandet (VAT code 48)

However, after I spoke with my accountant again, they advised that I cannot use this setup because Etsy is based in Ireland and does not handle VAT in the same way as in Sweden.

They suggested that I use the following instead, without any VAT codes:

2440 – Leverantörsskulder

4056 – Inköp varor 25% EU (no VAT code)

I’m quite confused and would really appreciate it if you could explain how I should correctly record this kind of purchase.

Thank you very much for your help.

Best regards,

Löst! Gå till lösning.

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Hi

When you do a purchase from another member country of the EU you should always account for a reversed charge VAT as long as the seller has a VAT number. Ireland is still a member of the EU.

https://www.skatteverket.se/foretag/moms/kopavarorochtjanster/inkopfranandraeulander/kopavarorfranan...

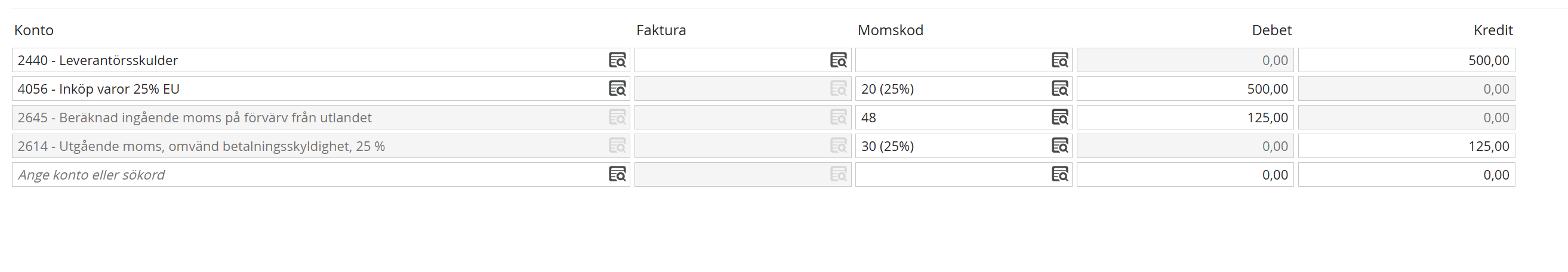

A purchase for 500 SEK should be accounted for like the picture shows.

/Joachim

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Hi Joachim,

Thank you for the reply.

I have another question. If the merchants are not based in EU but they sell items via Etsy, can I still register the purchase as you recommended? Or this only apply for merchants who are based in EU.

Thank you!

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

What you have to look for, is the sellers VAT-number, if the VAT-number is for a member of the EU or outside the EU and book according to that information.

Best regards,

Lena

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Thank you, Lena!

Utbildningar

Spiris

Copyright 2026 Visma Spcs. All rights reserved.