- Prenumerera på RSS-flöde

- Markera inlägget som nytt

- Markera ämnet som läst

- Pinna detta Inlägg för min användare

- Bokmärke

- Följ

- Inaktivera

- Utskriftsvänlig sida

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Wolt food delivery

Hi i want to know how to book this invoice its payment came from wolt food delivery its new to me i want help how to book i attach invoice

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

What service do they provide for your company? Do they provide food? When I look at the yearly books for 2024 it is a kind of service, like a website or something that they provide sale support and/or delivery service related to an order platform. Please explain this 🙂

Best regards,

Lena

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

My company works with wolt

like we provide delivery services and they pay us

its like food delivery

we are a service provider

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Hej

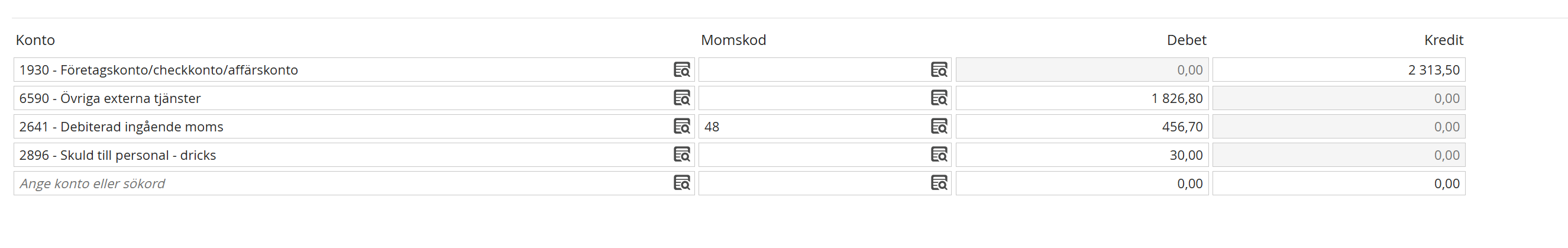

Du bokför fakturan på följande sätt.

/Joachim

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Hi

I want to clear

my company provides services for example to deliver food and they pay me for that work ?

are you sure it will be 6590

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Because the amount cames in my account and i guess it should not be 3041 ? Can you re check and do again?

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Hi

Is it money you recieve? If so the exampel of the bookkeeping i sent will not be correct. Please verify that it concerns a payment you recieve or if it is a payment you pay to wolt.

/Joachim

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

I recived this amount

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Yes, and I believe they have made an error here. They cannot send you and invoice. An invoice is saying YOU are the one to pay, not the other way around. I guess this is a reversed charge VAT and they should have sent you an credit invoice, since they are paying you. Anything else is wrong. The best thing you can do, to make it correct from your side here, is to book this invoice as a credit note in Spiris and then pay that credit note with the money you received from them.

IF you are providing a service with reversed VAT, the account number is 3200. But you need the go to the accounting manual and change the VAT to 41, reversed charge.

Best regards,

Lena

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Yes its correct they pay me because i work for them its not a invoice my bad i explain wrong

its a credit invoice

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

I does not SAY it is a credit invoice. The next time they should send you a correct one.

Good luck with everything and best regards,

Lena

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

I do like this

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

But now you didn't use account 3200 and you certainly did not use the VAT code 41 as I asked you to.

Best regards,

Lena

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Check this link its a similar payment but here its booked differently

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Here is some extra information about the payment i received

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

Hi

Since you get a payment from Wolt in Sweden i would say your picture of your bookeeping is correct if the company is keeping the 30 kr for tip without any VAT.

/Joachim

- Markera som ny

- Bokmärke

- Prenumerera

- Inaktivera

- Prenumerera på RSS-flöde

- Markera

- Skriv ut

I doesn't look like this invoice is made in eEkonomi, and it is called a Self-billing Invoice. Self-billing invoices are used for reversed VAT, at least it used to be some years ago.

Best regards, Lena

Utbildningar

Spiris

Copyright 2025 Visma Spcs. All rights reserved.